Internal Revenue Service agents want to review communications between New Hampshire state liquor store employees and two New York residents, one of whom was arrested in that state in December on charges of bootlegging.

Earlier story: Amid Calls for Investigation, IRS Said to Have Visited N.H. Liquor Stores

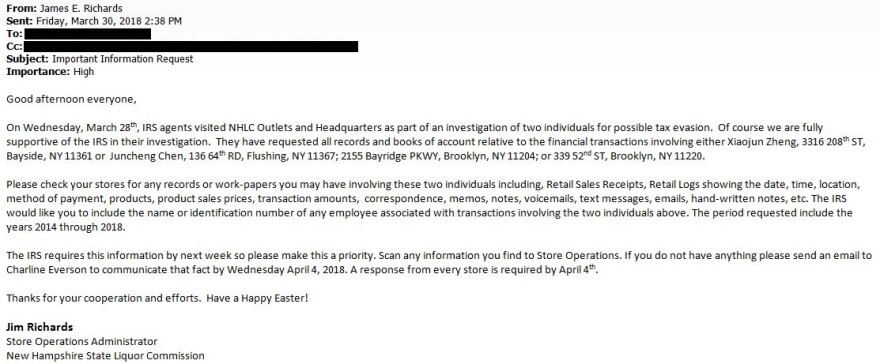

An email sent by James Richards, store operations administrator for the New Hampshire Liquor Commission, to all retail store managers last Friday says that IRS agents want copies of any emails, notes, voicemails or text messages exchanged between store employees and the two New York men, identified as Xiaojun Zheng and Juncheng Chen, as well as sales receipts and their method of payment.

The IRS is also requesting the names of all employees who completed transactions involving the two men dating back to 2014, according to the email.

A copy of the email, which was obtained by NHPR, says that IRS agents visited the New Hampshire Liquor Commission’s Concord headquarters on March 28th, along with several retail stores, as previously reported.

The investigation by IRS agents comes amid calls by Executive Councilor Andru Volinsky for the state Attorney General’s office to look into how the Liquor Commission, which manages 79 retail stores statewide, handles large all-cash transactions, many of which involve out of state residents.

On December 8th of last year, Chen, 45, was pulled over by New York State Police on Interstate 95 in the town of Rye, north of New York City. Inside Chen’s vehicle, police found 757 liters of liquor, including large quantities of Hennessy cognac, allegedly a favored spirit of cross-border bootleggers.

According to the New York State Department of Taxation, Chen allegedly made his purchases at five different New Hampshire liquor stores. He has been arraigned on felony charges for possessing untaxed liquor, and faces up to four years in prison. He has pleaded not guilty, and has his next court date on April 17.

It is unclear if the IRS’s interest in Xiaojun Zheng is related to the case involving Chen. Court records show no outstanding charges in New York State or federal courts involving Zheng.

The IRS requires most businesses to file a form when customers make all-cash purchases in excess of $10,000. It is illegal to “structure” a transaction so that the dollar value falls below that threshold by splitting up the purchase by visiting multiple stores.

In a February letter to Governor Chris Sununu and Attorney General Gordon MacDonald, Volinsky says he witnessed a large transaction structured in such a way to avoid having to complete IRS Form 8300. He’s calling for an investigation in Liquor Commission policies on this topic to determine if the agency is “actively facilitating these types of transactions or simply turning a blind eye.”

The Liquor Commission denies the allegations made by Volinsky, and says it has a long track record of following all state and federal laws. The Commission adds that its policies surrounding large all-cash transactions have been reviewed numerous times and always found to be legally sound.

The Attorney General’s office says it will look into the implementation of those policies at the request of Volinsky, but hasn’t provided a timeline of when that review may be completed.