The so-called "New Hampshire Advantage" is part of our state's branding. It's about limited government. But maybe more important, it's about low taxes.

The state has no sales or income tax, a point of pride for many residents and politicians. But is New Hampshire's anti-tax attitude really so unique?

In a word: yes.

As part of our continuing series Only in NH, in which we answer listener questions about quirks of the Granite State, we're tackling this one from Mary Douglas:

Why does New Hampshire seem so against having a state income tax?

New Hampshire is the only state without either a sales tax or income tax except Alaska, but Alaska gets a huge amount of revenue from the oil and extraction industries. So, New Hampshire's tax structure is unique in the United States.

And then, of course, there’s "the Pledge."

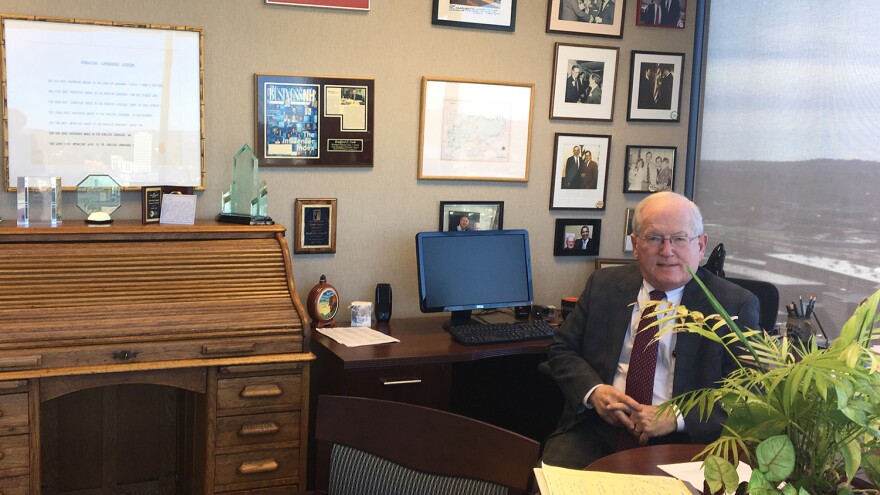

Joe McQuaid is the publisher of the Union Leader in Manchester. He's also an influential Republican voice in New Hampshire politics.

"The Pledge is something that the people running for governor of the state, take a simple pledge to veto any broad-based sales or income tax that the legislature might for some crazy reason pass and put on the governor’s desk."

Democrat or Republican, almost every serious candidate for governor for the past 40 years has had to take the Pledge, to promise they won’t even consider a broad-based state income or sales tax.

In this case, "broad-based" means taxing a wide swath of the population, rather than a narrow-base tax, like a cigarette tax, or an interests and dividends tax, both of which New Hampshire does have.

And there is a huge debate about all this: some people say that it's been working. Limited government is good, they say. We're #7 on the Tax Foundation's State Business Climate Index, after all.

But on the other hand, our tax structure puts a lot of pressure on local property taxes, and there are always questions around the things the state doesn't fund to the extent other states do, including the university system, corrections, and social service programs.

But either way, how did we get to this point? What is it about New Hampshire that makes us so anti-tax?

It can be a little confusing, especially for someone who's new to the state, like me. And like Mary Douglas, the listener whose question prompted this story. She moved to New Hampshire in 2005.

"Has there been a kind of rhetoric or tone that surprised you?" I asked Mary.

"I can’t pin it down to anything. I just wondered why that is. It can’t even be considered and I wondered why. It seems like it might be tied to the 'Live Free or Die' thing, I don’t know," she said.

It just might.

Bucking the Pledge

The last gubernatorial candidate not to take the pledge was Jackie Cilley, a Democrat who ran in 2012.

"What made you decide not to take the pledge?"

"Because I’m absolutely opposed to it," she told me, "It’s a gimmick!"

Cilley even ran a campaign ad comparing signing the Pledge to becoming a zombie.

Watch Jackie Cilley's Zombie ad:

Cilley lost her primary race to Maggie Hassan, who served two terms and was elected in 2016 to the U.S. Senate. She doesn't have regrets, though.

"I refused to take the Pledge and I said it’s time we have a conversation about what we believe government should provide in the state of New Hampshire," she said. "And I got painted immediately, as 'Oh, she’s in there fighting for an income tax.' So it’s difficult even to have a conversation about it.'"

Cilley said people told her she was brave for taking that stand, but she suspects there were many who talked about her as "foolhardy."

"I've learned that since that campaign, that it was an absolute no-starter for a campaign. That you could not win in a general election by not taking the Pledge in New Hampshire. And I think that’s really sad."

The father of the Pledge

It wasn't always this way. Take Arnie Arnesen, a radio host and former state representative who calls herself "a politician in recovery." Arnesen's a big proponent of overhauling the tax system in favor of a state income tax.

Then there's McQuaid, the Union Leader publisher, who definitely does not share Arnesen's views. He says everyone in New Hampshire should have to take what he calls "a spit test."

And, finally, there's Brad Cook. He's a lawyer and weekly columnist for the New Hampshire Business Review since the early 90s.

Cook and McQuaid are actually neighbors. And they’ve both got offices in Manchester - Brad’s in the corner office on the 17th floor of a downtown law firm, Joe’s on the newsroom floor of the Union Leader on the outskirts of the Queen City.

But both of their offices - and Arnie Arnesen's house in Concord - are decorated with New Hampshire memorabilia -- black and white pictures of governors and political candidates and newspaper editors.

All three told me you can't tell the story of New Hampshire and taxes without talking about William Loeb.

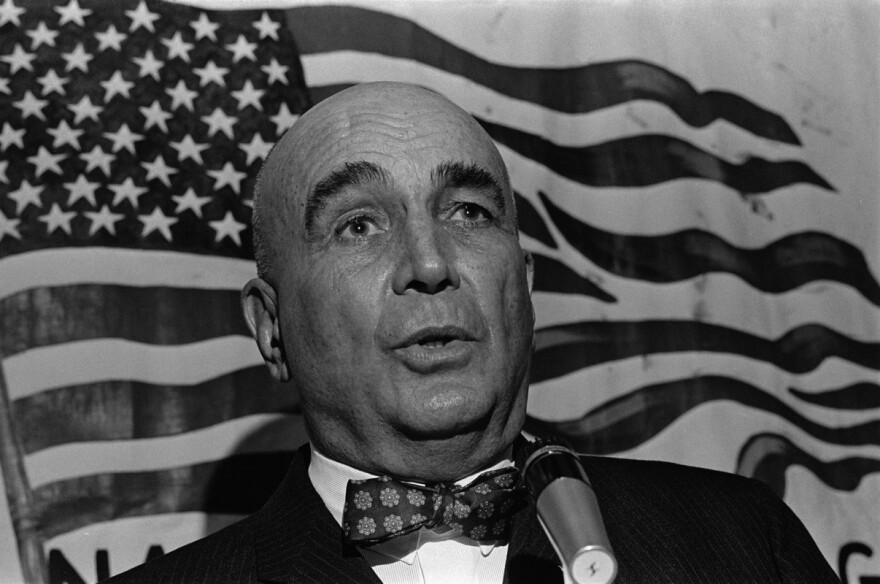

"Well before Fox, before social media, before cable TV, we had William Loeb," Arnesen said. "And William Loeb was the publisher of the most powerful statewide newspaper called The Union Leader."

As McQuaid put it, "William Loeb was from 1946 to 1981 a pretty influential figure in the state of New Hampshire."

And, as Cook pointed out, "No media source in New Hampshire has the dominance that the Union Leader had when he was the owner."

It’s hard to overstate: New Hampshire today would not be the same without the influence of William Loeb. He was very conservative and one of the most powerful figures in the state for 35 years - and he got his fair share of national attention too.

By 1948, Loeb had bought and combined New Hampshire’s two major newspapers. The Union Leader was born and for decades held a media monopoly in New Hampshire.

But Loeb didn't live in the state. He and his wife were residents of Reno, Nevada, but they had a second home in Massachusetts. He ran the newspaper in a "very controversial and colorful way," Cook explained, and eventually, he decided to run an editorial every day of the week, except for Sundays.

He often used these editorials to rail about his political ideas, but they would also reveal Loeb's darker side. In 1950, Loeb published his baptismal certificate in order to prove he wasn't Jewish. He also described black people as savages.

Listen to William Loeb talk about why New Hampshire would be better off without black people:

So, what are some examples of Loeb's influence on the Granite State?

"The reason you’re here," McQuaid told me. "The lack of a broad-base taxes in New Hampshire, William Loeb had a great deal to do with that."

McQuaid says Loeb believed the more money you give the government, the more they would expand. The editorial cartoonist at The Union Leader even had a character known as "Old Broad Base," which was a big money bag with big eyes and "Mother" tattooed on one arm, "Bleed 'em dry" tattooed on the other.

And if Loeb had a pet issue or something he wanted to happen?

"He'd pound on it every day," Brad Cook said. "You wouldn’t have heard of the pledge if he didn’t keep pounding it all the time."

Live Free and Don't Pay Taxes

But William Loeb didn’t invent New Hampshire’s anti-tax attitude. The belief in limited government has deep roots. Cook says it dates back all the way back to New Hampshire’s colonial constitution, which was written in 1776, right at the beginning of the American Revolution

It's hard to overstate: New Hampshire today would not be the same without the influence of William Loeb.

Our state's government is weak by design, diffuse by design, he said. The people who wrote our constitution made sure we had a big house, a small state senate, and a two-year term for governors, all so there wouldn’t be a strong central government.

"I think part of the aversion to taxes has been by people who have thought about this way: not sending a lot of money to Concord that would give Concord more power, the ability to spend more and become a more powerful 'gubmint.'"

On top of that, income taxes are only about a century old in the United States.

It was only after the Sixteenth Amendment passed in 1913 that the federal government was even allowed to collect taxes off income. But when it was first proposed two years earlier 1911, New Hampshire rejected it. And when the amendment did pass, New Hampshire was the last state to ratify it.

After the federal government, states started implementing income taxes too , but New Hampshire wasn’t among them. As the New York Times reported in 1929: “New Hampshire manifests small enthusiasm for an income tax.”

But that wasn’t true across-the-board. In 1949, Governor Sherman Adams proposed an income tax. And in the late 60s, moderate Republican Walter Peterson decided to take on the tax code, which hadn’t changed much since the 19th century agrarian economy. There were a lot of creaky old taxes on the books, like the “stock and trade” tax* that would levy a tax on inventory.

Peterson hoped to clean house. But in 1971, he also proposed a 3 percent income tax, which drew the ire of William Loeb.

"In a way, the problem for Walter Peterson was Bill Loeb," Arnie Arnesen said.

"During election times, he would whack the candidates he didn’t like, and promoted the candidates he didn’t like in no uncertain terms, with no varnish," Joe McQuaid said, noting Loeb is infamous for having called President John F. Kennedy the "Number one liar in the United States."

Loeb is also credited with crippling Sen. Edmund Muskie’s presidential campaign in 1972 by publishing a forged letter that accused Muskie of saying ‘Canuck,’ a derogatory term for French Canadians. Muskie responded with a speech in front of the newspaper's office, during which reporters claimed he broke down in tears several times. (Muskie denied this, saying what appeared to be tears on his face were actually melting snowflakes.)

"Ax the Tax"

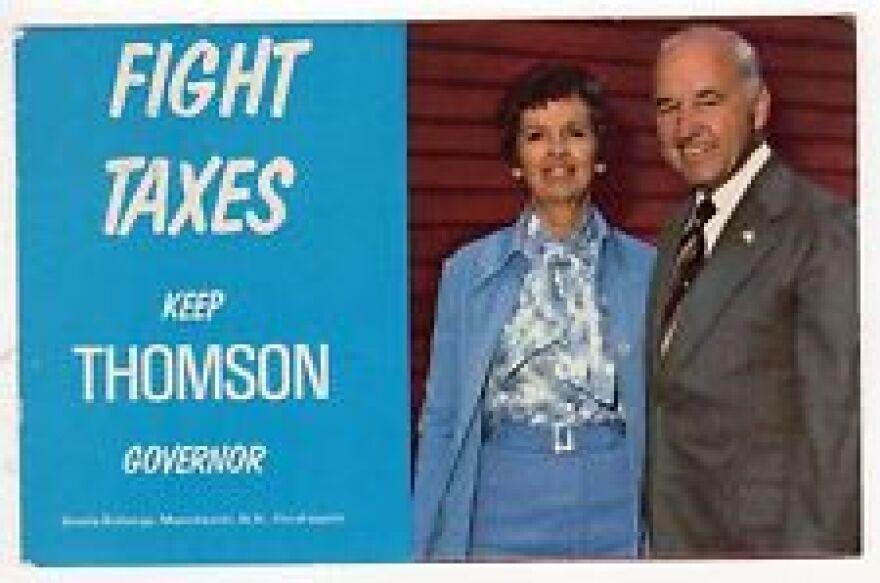

William Loeb propped up and tore down candidates for decades, but none with more success than Meldrim Thomson Jr.

"Mel said he was out haying his field one day and got off the tractor and ran for governor," said Joe McQuaid."

His campaign slogan: Ax the Tax.

"Somebody gave him an ax handle and he carried it around in his car . I don’t think he ever committed mayhem with it. So Mel Thomson and Loeb were sort of kismet."

Governor Peterson had been reforming the tax system and entertaining the idea of an income tax. And Thomson was saying he wouldn't let that happen. It took three tries, but in 1972, Mel Thomson beat Walter Peterson to win the Republican primary, and then he was elected governor.

Meldrim Thomson was a very conservative, fiery character. He was notorious for inflammatory positions like suggesting that the national guard carry nuclear weapons or lobbying for an oil refinery on the Seacoast. Loeb remained a close friend and advisor. They talked on the phone all the time.

New Hampshire’s state motto wasn’t widespread until Mel Thomson’s tenure. The song “Live Free or Die” comes from “Keep New Hampshire #1” a record filled with songs to promote Mel Thomson’s campaign for a third term.

A lot of what is considered intrinsic to New Hampshire today comes the era of Mel Thomson and William Loeb - and that includes the anti-tax pledge.

"Did he invent the pledge, Loeb?"

"Oh god, yes," Joe McQuaid said. "Well...I don’t know if Loeb did or Mel did, it’s kind of a cocktail. What is amazing is that the ghost of Mel and Bill, is still so present today."

Brad Cook added that what changed during that era was that any momentum to reform the state's tax system was halted, at just about every level of government.

"He’d want to know if someone running for Ward 1 alderman in Manchester was taking the pledge. Last I checked they couldn’t pass a broad-based tax. I mean it became something that candidates would say, 'Let’s get it out of the way.'"

And for the most part, they have.

As McQuaid explained, "Hugh Gallen beat Mel Thomson, and Hugh Gallen took the pledge against broad based sales or income taxes. So did John Sununu. So did Judd Gregg. So did John Lynch. So did Craig Benson. So did Jeanne Shaheen the first couple of times."

Listen to the song "Live Free or Die":

So, who runs the pledge? Does it have a keeper?

"There’s no keeper of the pledge. It’s just so ingrained in the state that retired teachers from Maryland have heard about it. That’s great."

Punching above its weight?

This strong stance on taxes, from Loeb, from the original constitution, has calcified, cementing itself as part of New Hampshire’s identity.

But it’s not like New Hampshire couldn’t change. The last state to implement an income tax was Connecticut in 1991. It was the 41st state to do so. But it was a controversial move. At the time, some politicians promised property tax relief would also come along, but that didn’t pan out. Now, Connecticut has both an income tax and high local property taxes, and it consistently ranks among the highest taxed states in the country.

For some in New Hampshire, Connecticut is a cautionary tale. When I called Jared Walzcak at the Tax Foundation in Washington, D.C., which rates New Hampshire as No. 7 on its State Business Tax Climate index, he told me there’s something to the idea of the New Hampshire Advantage.

"New Hampshire generally has a reputation as a low-tax statement. And that therefore makes the state fairly attractive for investments and for people to locate their activities in. And the state has done well for itself over the years, if you look regionally, especially when you look at the demographics of the state, you see a state that has been probably punching above its weight for a long time."

The fact that it feels impossible to discuss tax reform doesn’t sit well with many people. Including Arnie Arnesen. She’s not sure about the idea that the state is working just fine without any broad-based taxes.

"We’re not a state without taxes. We’re a state with some of the highest fees, highest registration fees, highest student tuition costs, we spend the least amount of money when it comes to aid and support with opioid addictions."

Arnesen actually ran for governor in 1992, promising to enact a state income tax. She was the first woman to win a primary for a major party and the first person to win a primary without taking the pledge since Thomson. But she lost in the general election.

Later, Mark Fernald tried again in the early 2000s. And finally, in 2012, there was Jackie Cilley with her zombie ad.

Cilley thinks it would take a serious initiative to pass a state income tax, and it would have to come from citizens.

"When somebody tells them that they will not support any type of broad-based tax, we ought to be clear with citizens. What we’re really telling you is that the state will continue to be run on your property taxes. Those will continue to go up."

But, in the same year that Cilley lost her bid for governor, there was a referendum on the ballot, proposing a constitutional amendment to never implement a state income tax.

The referendum won 57 percent of the vote, but that wasn't enough to pass. It needed a two-thirds majority.

Do you have a question about some quirk of New Hampshire or your community? Submit it at our Only in NH project page right here, and we could be in touch for a future story.